Successful trading demands understanding price movements in financial markets, which appear complex. Numerous traders pursue techniques to understand market actions and forecast subsequent price movements. One frequently asked question is, What is price action trading? This approach represents one of the effective trading strategies that examines price movement directly instead of depending on derived market indicators. This article delivers a complete overview that explains the essential principles of price action trading while demonstrating how to apply its primary patterns to make effective trading decisions.

In this exploration of price action trading, we will examine its fundamental simplicity and study common patterns, including the Inside Bar, Pin Bar, and Fakey. In this learning process, you will discover how to locate these trading setups and improve their dependability through the study of confluence. This guide will equip you with fundamental knowledge about pure price action analysis to enable further exploration of the field.

What Is Price Action Trading?

Price action trading is a technique for speculating in financial markets. It involves studying basic price movement over time. Both retail traders and institutional traders, such as hedge fund managers, frequently use this technique to predict security price movements. Price action refers to the method used to understand price changes by examining the ‘action’ of price in markets that display high liquidity and volatility.

Price action trading stands out as a pure form of technical analysis because it examines only the present market price alongside historical price movements without using derivative indicators. Traders who practice price action analysis focus solely on the authentic data produced by market price changes throughout time. Traders who maintain exclusive concentration create mental models of market structure, which help them cultivate a personal sense of profitable trading instincts.

The Philosophy Behind Price Action Trading

Price action trading’s fundamental principle emphasizes simplicity with the guiding principle ‘KISS’, which stands for Keep It Simple Stupid. Price action traders purposefully keep their charts free from multiple technical indicators while they also disregard economic news when making trading decisions. They maintain an exclusive focus on the fundamental price movements that remain untouched and pure. The philosophy behind “clean chart trading” and “naked trading” is based on the conviction that market price action reflects all relevant influencing factors.

The basic approach makes trading procedures much easier to manage. Price action analysis enables traders to understand market participant behavior as they interpret human-driven signals reflected in price movements on the chart. Experienced price action traders who use direct interpretation to analyze the market develop an intuitive understanding, which typically results in their ongoing profitability.

Key Elements of Price Action Analysis

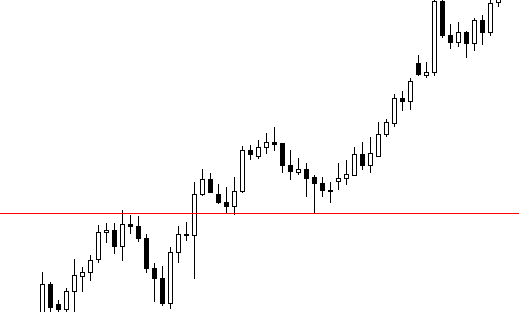

Price action traders conduct detailed examinations of market historical price movement, with an emphasis on the last three to six months. Analysis of this specific timeframe is essential for understanding current price movements and recognizing ongoing market trends. Price action traders emphasize the most recent price movements while maintaining a secondary focus on older price data to understand broad market structures and long-term trends.

This analysis depends on structural elements that originate from price data. The analysis involves identifying swing highs and swing lows because they mark significant price reversal points. The study of support and resistance levels emerges as a vital component in technical analysis. Critical zones for market entries, exits, or trend continuations exist at horizontal price levels that have historically reversed buying or selling pressure.

Understanding Core Price Action Patterns

When discussing what is price action trading? The essential element consists of patterns recognized as ‘triggers,’ ‘setups,’ or ‘signals.’ Price chart formations create strong visual indications of upcoming price movements and shifts in market sentiment. Successful trading decisions depend on the proper identification and interpretation of these patterns since they frequently signal major price reversals or continuations.

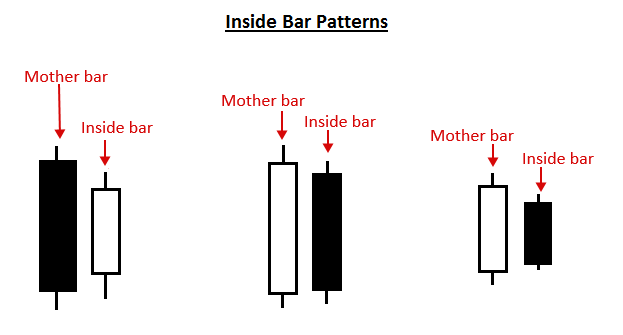

The Inside Bar Pattern

The inside bar pattern includes two components: an inside bar, which follows a mother bar. The inside bar pattern takes shape between the high and low points of its preceding mother bar. The pattern usually represents market consolidation or indecision, but traders often use it to predict breakouts in trending markets, which signal potential price continuations. The pattern functions as a reversal signal if it appears at an important support or resistance level.

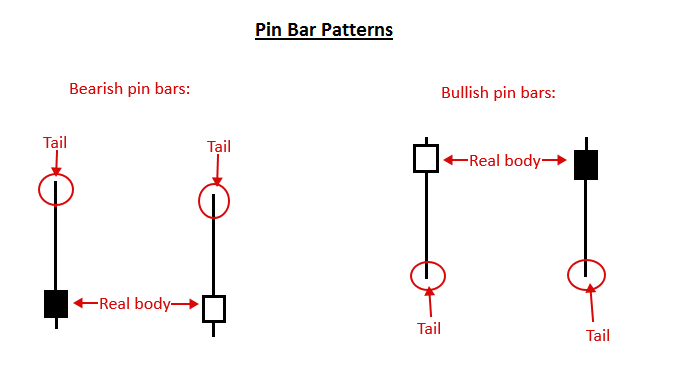

The Pin Bar Pattern

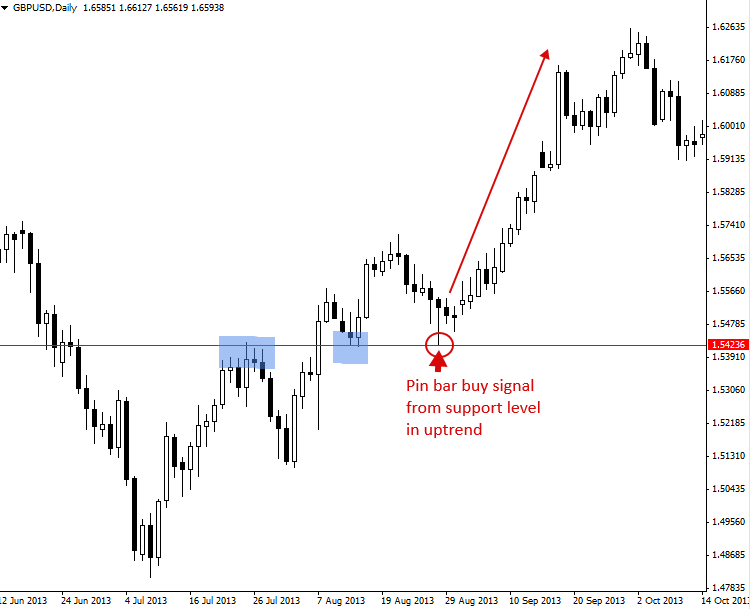

The pin bar pattern emerges as one candlestick with a minimal body flanked by an extended ‘shadow’ or ‘tail’ that stretches predominantly in a single direction. Market participants can interpret this pattern as evidence of price rejection leading to a potential reversal trend. Pin bars provide reliable signals in trending markets as well as range-bound environments or when trading against trends near important levels, since their extended tail shows where prices won’t move.

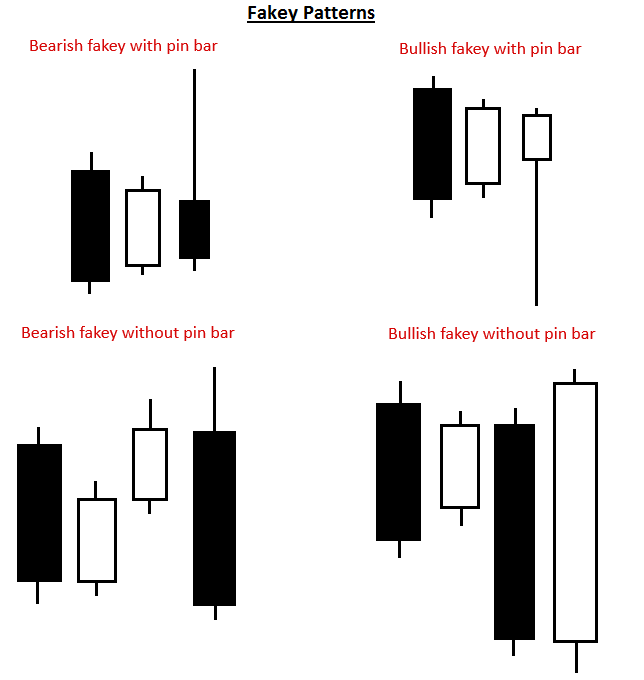

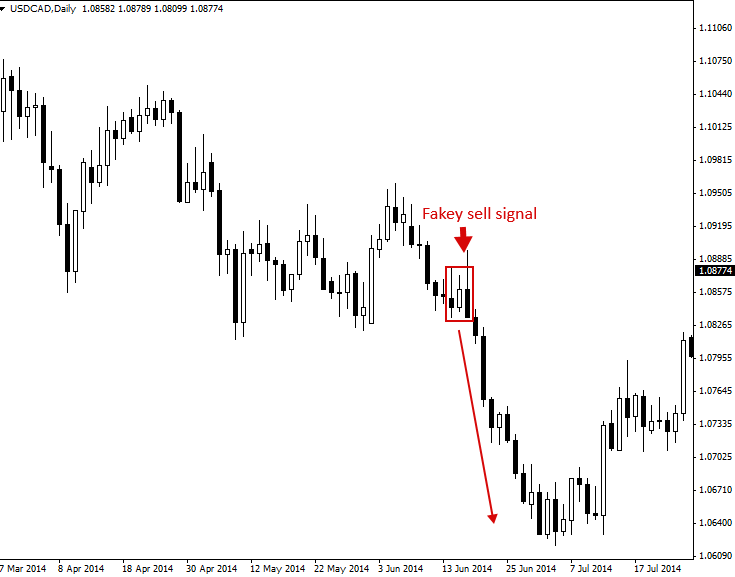

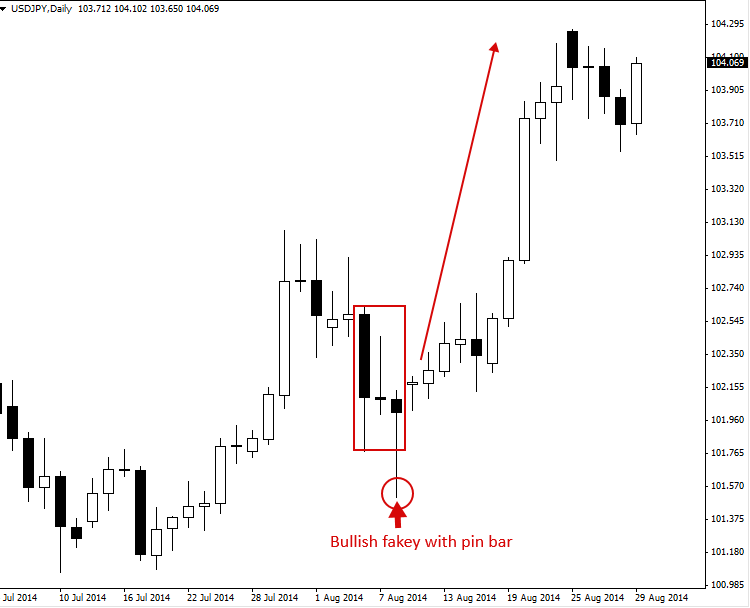

The Fakey Pattern

The fakey pattern represents an initial breakout from the inside bar before price reverses into the original range. The fakey pattern manifests when price moves outside an inside bar’s range, signaling a real move before quickly reversing to finish inside the mother bar or inside bar’s initial range. The fake-out triggers a strong price movement that opposes the initial false breakout direction while forming a powerful reversal setup.

Applying Price Action Patterns in Real-World Scenarios

While grasping price action patterns serves as the basis for trading knowledge, traders must use strategic thinking to implement these patterns successfully in live market conditions. A fundamental rule is to execute trades that follow the current trend of the market. The likelihood of success increases when traders spot a bearish fakey sell signal during an established downtrend because it matches the market’s existing momentum and bias.

A bullish fakey pin bar pattern in a rising market context creates stronger opportunities for profitable trading strategies. Effective trading strategies for markets with strong near-term trends should focus on setups that match the market’s aggressive momentum. Strongly trending markets provide optimal conditions for inside bar and inside pin bar combo patterns, which underscore the necessity of contextual analysis together with pattern recognition.

Enhancing Trading Signals with Confluence

Price action signals require an analysis of both the pattern formation and its specific position on the price chart. Different pin bars and inside bars exhibit varying levels of tradability. Price action signals achieve maximum reliability when multiple market factors come together at “confluent” points to strengthen them. The concept of confluence represents the merging of different elements that support each other.

A pin bar buy signal that occurs at a defined support level during an established uptrend demonstrates strong confluence between multiple market factors. The existing trend direction, together with the identified support level and the pin bar signal alignment, creates a powerful basis for successful trading. Price action signals with multiple confluent factors appear more reliable and probable to experienced traders.

Final Thoughts on Price Action Trading

The contents of this article establish a basic understanding of what is price action trading? It serves as a pure and simplified approach to market technical analysis. Our study has focused on its fundamental principle, which centers around raw price data analysis and promotes the use of uncluttered charts without complex indicators. You currently understand the distinct characteristics of essential price action patterns, including the Inside Bar, Pin Bar, and Fakey, and their potential market implications.

We’ve demonstrated the critical importance of context and confluence to show how pattern alignment with market trends and key support and resistance levels can dramatically improve their effectiveness and reliability. Learning these essential principles enables you to decode market “clues” with greater accuracy, which leads to a more instinctive trading method that can generate profits.