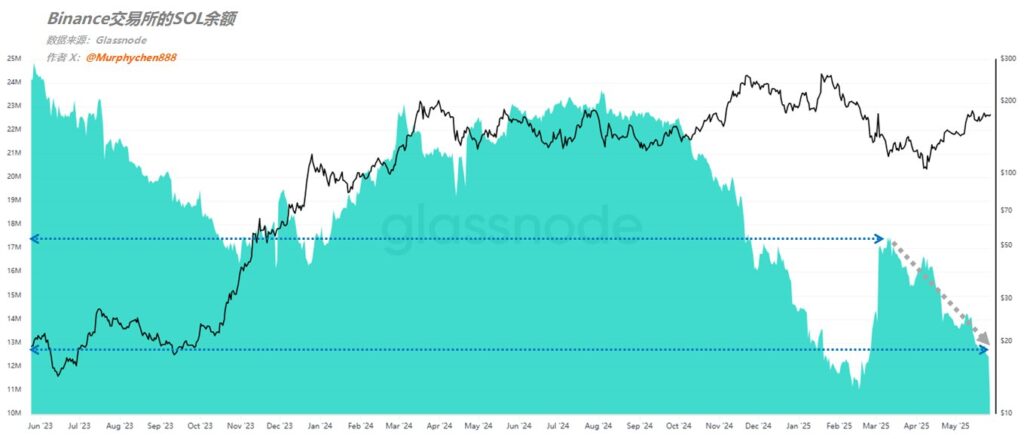

The SOL token supply on centralized exchanges diminished by 27.4% to 27.01 million, which is near its lowest level since October 2022. Market participants are monitoring the significant reduction, which emerged in early March. According to on-chain analyst Murphy, the significant drop in SOL supply presents a strong bullish market signal, offering a positive Solana price prediction for Solana cryptocurrency.

The significant reduction of SOL on key exchanges such as Binance, Coinbase, and Kraken shows that investors are increasingly choosing to retain their tokens instead of selling them. Glassnode data reveals that current market activity shows increased demand for SOL. This situation may cause SOL prices to increase while making $162-$176 a vital “chip accumulation zone” that functions as both support and resistance.

Why Solana’s Exchange Supply is Dwindling

The Solana supply on centralized exchanges has sharply decreased from 37.22 million in early March to today’s 27.01 million. This dramatic 27.4% decline places the CEX supply at its lowest level since October of 2022 and represents one of the most substantial drops recorded recently. The substantial reduction in SOL token supply indicates strong asset support because fewer tokens remain available for quick transactions.

According to Analyst Murphy, SOL‘s CEX supply depletion stems from numerous strong fundamental forces that promote a favorable future for the asset. The current investment behavior shows that traders are withdrawing their assets from exchanges, which demonstrates their preference for holding investments over longer periods instead of short-term market plays. Assets becoming scarce on exchanges often indicate growing market demand.

Unpacking Solana’s On-Chain Shift: Key Market Drivers

Institutional crypto demand growth alongside increased ETF activity represents the main cause of the significant SOL token supply reduction. According to Bloomberg, there is a 90% chance that Solana spot ETFs filed for by major financial firms such as Grayscale, Fidelity, and Franklin will be approved by 2025. The rise in staking activities led to 64% of circulating SOL being transferred to on-chain yield-generating protocols, including Raydium, Jito, and Marinade, resulting in supply lock-up.

The trading of SOL has moved extensively to decentralized exchanges because of increased activity involving meme coins. Meme coins on Solana represent more than 92% of DEX trading volume, which has redirected SOL holdings from traditional CEXs. Major holders demonstrate substantial buy-side pressure as large SOL transfers from Binance and Kraken move into unknown wallets, which shows continuous whale accumulation.

Solana’s Market Dynamics and Future Price Potential

Despite evolving supply dynamics, Solana maintains its strength as it trades at roughly $174 following a 0.5% price decrease within the last day. The past month saw SOL achieve substantial growth of more than 15% as its market value reached $90.7 billion and daily trading volume expanded by 23.3% to reach $4 billion. Market participants should regard the $162 to $176 trading range as vitally important.

Murphy believes that crossing the $176 mark would enable SOL to effectively eliminate substantial amounts of “trapped supply” from the market. The breakthrough opens opportunities for price expansion, which could lead to a revised Solana price prediction with higher values based on ongoing bullish market sentiment.

Long-Term Implications for Solana’s Growth Trajectory

SOL token supply on CEXs reached near-historic lows due to numerous factors such as increased institutional crypto demand, active staking participation, booming DEX volume driven by meme coin activity, and deliberate whale buying strategies. Multiple integrated factors work together to establish SOL with solid foundational support, which demonstrates an evolving ecosystem featuring broad and consistent demand.

The market’s recent on-chain activity shows that investors are preparing Solana for future expansion and enhanced stability. The decreasing exchange supply of SOL, combined with strengthening demand across market segments, positions it as a key investment target. The existing market conditions reveal a consolidation and accumulation stage that may shape Solana’s future direction over the next several months.