Ripple’s native cryptocurrency, XRP, maintained its trading position from January throughout the first half of the year due to consolidation. In line with XRP price prediction, it traded at $2.3188 on May 27 after experiencing a 32% drop from its November peak despite multiple expected market-moving events such as new ETF filings and CME futures debut, along with the SEC vs. Ripple lawsuit settlement.

Market analysts are starting to notice powerful indications that the lengthy period of price stabilization may lead to substantial long-term profit opportunities. Market analysts are currently debating a high XRP price prediction of $10 due to multiple factors, including positive technical indicators, together with beneficial macroeconomic changes, accompanied by rising institutional interest and Ripple Labs’ strategic growth moves.

XRP Technical Analysis: Bullish Chart Patterns

The XRP technical analysis of the XRP price chart displays powerful patterns that point toward an upcoming breakout. The “cup and handle” pattern emerged as a dominant formation during the period from April 2021 through November of last year at the value of $1.966. The asset has finished its “cup” phase while actively creating its “handle”, which shows an 85% depth from the top edge and points to a potential price target at $3.66.

XRP technical analysis reveals a “bullish pennant” pattern, which starts with a vertical price surge and forms into a symmetrical triangle. The possible breakout becomes more apparent as the pennant’s two trendlines draw closer together. If XRP exceeds its current year-to-date peak of $3.4, it will likely trigger a 117% increase towards the important psychological mark of $5, which could launch it into further price increases.

Macro Trends and Potential XRP ETF Approval

The forecast for XRP price prediction for future gains looks promising due to the impact of multiple macro and institutional catalysts alongside technical indicators. Experts predict the Federal Reserve will start reducing interest rates in September, which will have a positive impact on BTC as well as altcoins, including XRP. The change in monetary policy stands to introduce new liquidity and confidence into the cryptocurrency market.

Rumors concerning potential XRP ETF approval continue to strengthen the bullish story as BlackRock, a major financial player, shows plans to compete alongside existing applicants VanEck and Franklin Templeton. BlackRock’s substantial impact within the ETF market indicates a strong bullish signal when they become involved. Market participants maintain a confident view as Polymarket estimates more than 80% probability for SEC approval of XRP ETFs.

Ripple’s Strategic Expansion & XRP Ledger Growth

Ripple Labs’ expansion strategy following its SEC legal battle reinforces the optimistic market view of XRP. The company actively seeks to bring additional U.S.-based enterprises into its RippleNet system to use the new regulatory clarity for boosting the adoption and usefulness of its blockchain services. The initiative serves as a crucial driver for enhancing network activity alongside boosting XRP demand.

The purchase of HiddenRoad by Ripple should lead to a substantial rise in transaction activity on the XRP Ledger network. The combination of this strategic decision with the new U.S. company onboarding will drive improvements in ledger utility and transaction volume. The ecosystem’s foundational growth creates a strong basis for an optimistic XRP price prediction, moving beyond speculative trading.

XRP’s Future: A Transformative Year Ahead

Robust patterns identified through XRP technical analysis, along with positive macroeconomic developments and growing institutional interest, create an optimistic outlook for the cryptocurrency’s future. Key chart patterns reaching completion, along with expected Federal Reserve rate cuts and a high probability of XRP ETF approval, establish conditions perfect for significant price gains. The combined forces at play indicate that XRP is set to experience substantial growth beyond its current recovery.

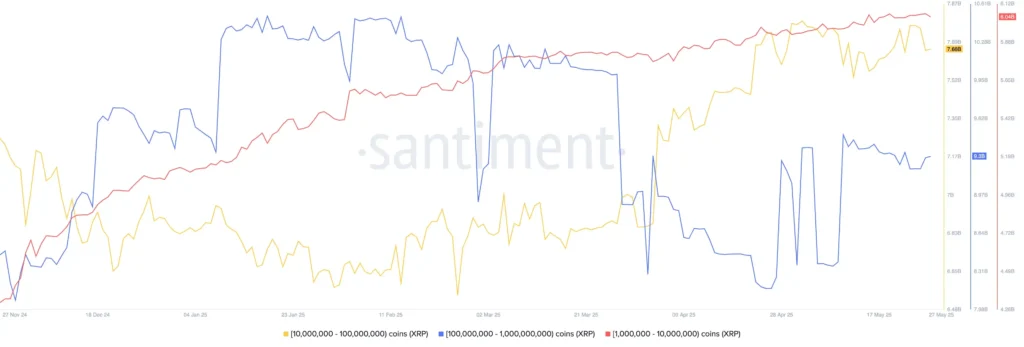

The likelihood of a $10 XRP price prediction becomes more credible when factoring in Ripple Labs’ growth strategies and XRP whales’ substantial holdings accumulation. A rally that shows a 335% increase from its present value would create a defining chapter for this cryptocurrency by establishing fresh market patterns and proving its essential functionality.