The Pi Network token fell by 22% in price last week, reaching a seven-day minimum of $0.61. Its market sentiment has turned more bearish, which aligns with the general downturn in the cryptocurrency sector. In the past week, the crypto market lost over $170 billion in market cap. This drop highlights troubling cryptocurrency market trends that significantly impacted investor trust.

Important technical indicators demonstrate strong support for the ongoing sell-off, which indicates continuous market pressure to fall. The BBTrend indicator shows a negative value, which indicates continued selling pressure around its lowest Bollinger Band. The Smart Money Index trend shows institutional investors withdrawing their positions, which heightens worries about further price drops for this altcoin in the short term.

Unpacking the Pi Network Token’s Downtrend

The Pi Network experienced a severe downturn with a 22% drop to $0.61. This is a reflection of the broader cryptocurrency market’s difficulties. During the last seven days, the entire global crypto market capitalization decreased by more than 5%, which represents a monetary loss of more than $170 billion. The broad market decline has definitely caused new PI token sell-offs that strengthen its existing bearish trend.

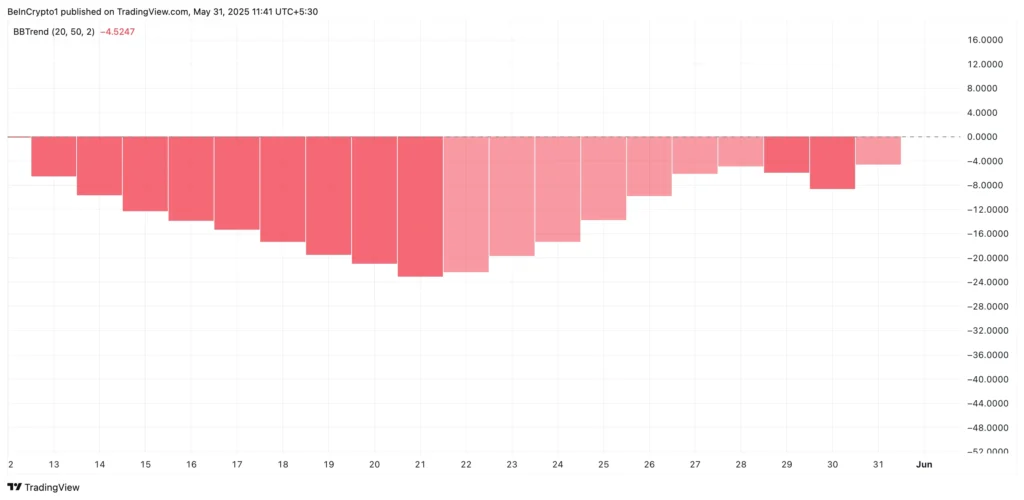

The BBTrend indicator provides clear evidence of increased sell-side pressure on PI, crucial for any thorough altcoin price analysis, because it displays ongoing red histogram bars. The present value of this indicator stands at -4.52, which demonstrates building bearish momentum. The persistent negative BBTrend demonstrates PI prices closing near the lower Bollinger Band, which shows ongoing selling pressure and suggests the price might continue to drop.

Institutional Exodus: Smart Money’s Impact on Altcoin Value

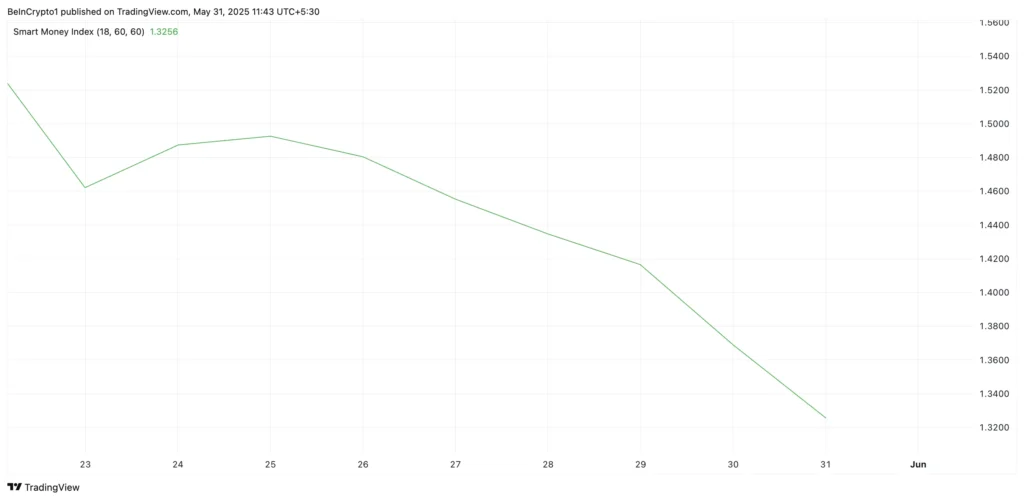

The bearish trend strengthens because Pi Network’s Smart Money Index (SMI) has experienced a significant drop in the past days, which reveals substantial withdrawal of institutional-grade investors known as “smart money.” This index monitors big investors’ actions during designated trading windows as a crucial leading indicator for altcoin price analysis. Its decline signals potentially larger price drops because institutional investors lose confidence.

A declining SMI in an asset like PI reveals a reduction in institutional demand. The diminished interest from sophisticated investors represents a substantial drop in trust regarding the asset’s future prospects. The asset becomes vulnerable to further price drops when the primary buying force exits the market.

Critical Support Levels: What’s Next for Pi Network Token?

The increasing selling pressure exposes the Pi Network token to potential additional losses soon. Persistent selling pressure may cause the altcoin to fall below its critical support level of $0.55, according to analysts. Without bull support to maintain this key support level, PI might fall back to its lowest recorded price of $0.40.

A strong increase in new demand for the token could prevent the emergence of this bearish situation. A significant increase in buying pressure could elevate Pi Network token prices towards the $0.86 threshold. The token’s short-term trajectory depends on whether buying interest can overpower the strong existing selling pressure.

Forecasting Pi Network’s Future: Navigating Crypto Market Trends

At present, the Pi Network token is encountering difficult times due to continuous selling pressure caused by widespread market decline and particular bearish signs. The ongoing downward BBTrend combined with a reduced Smart Money Index reveals both the intensity of the current downtrend and the token’s susceptibility to short-term further losses.

The current market prognosis suggests ongoing negative trends, yet understanding cryptocurrency market trends reveals a volatile landscape with swift changes. Whether the token can maintain its essential support level at $0.55 will play a crucial role. The path forward for this asset hinges on whether new buying momentum will develop to counteract the prevailing bearish mood permeating the PI ecosystem.