Pi Network (PI) remains confined within a narrow consolidation range since mid-April with price movements between $0.59 and $0.67 which establishes a 14% trading band. PI maintains its testing of the $0.58 lower boundary which intensifies fears of a breakdown if bearish forces continue to grow.

Technical indicators point to weakness. The RSI value stands at 38 which is under the neutral point of 50 while approaching oversold conditions. The MACD indicator demonstrates weakening momentum as the MACD line stays just above the signal line, but their paths are converging toward a potential bearish crossover.

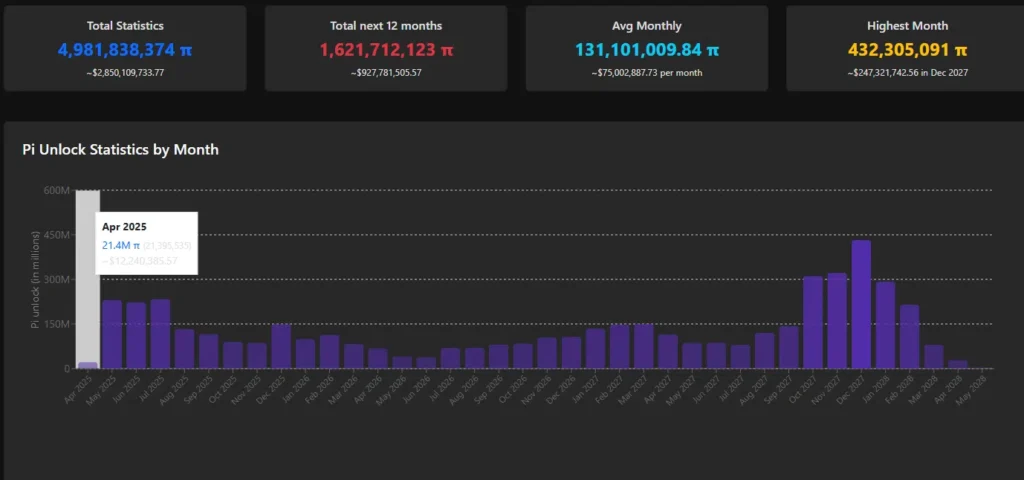

Future Token Unlocks Fuel Downward Risk for Pi Network

The situation becomes more bearish due to the potential further dilution risk. 21.4 million PI coins became unlocked during April which equates to about $12.3 million based on today’s market prices. Market members expect upcoming months to deliver substantially bigger token unlocks even though this month’s token release seems small.

Forecasts estimate that Pi Network will distribute an average of more than 131 million PI coins every month throughout the upcoming year. The anticipated rise in circulating supply creates a difficult situation for keeping existing token prices stable.

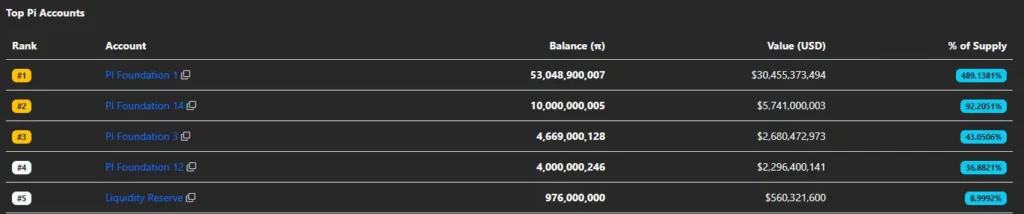

Pi Foundation’s Role Critical in Stabilizing PI Price

Pi Network faces the threat of persistent selling pressure unless Pi Foundation takes substantial corrective action by burning its large share of PI coins. The absence of any major updates or supply reduction strategy leads to fundamental indicators pointing toward continuous downward movement for PI.

The combination of dilution risks and weakening technical indicators drives investor caution due to potential near-term price breakdown concerns.