In the latest Ethereum price prediction, the daily chart reveals a classic bull flag pattern, indicating Ethereum (ETH) might reach a notable price surge towards $4,000 according to analyst predictions. The anticipated rally in Ethereum prices at 56% above current levels gains support from heightened network activity and elevated transaction fees, which demonstrate strong blockchain demand. Combined strong technical indicators and on-chain metrics have sparked renewed bullish sentiment toward Ethereum, which now generates widespread discussion about its price prediction.

The positive Ethereum price prediction receives additional support from significant increases in Total Value Locked (TVL) and substantial inflows into spot Ethereum Exchange Traded Funds (ETFs). Together, these factors show rising investor trust and increasing functional applications inside the Ethereum network. Market participants monitor the network’s sustained high engagement while anticipating a continued rise toward the $4,000 target price.

Technical Analysis Backs A Bullish Ethereum Price Prediction

A technical indicator known as a bull flag pattern has emerged on Ethereum’s price chart. This pattern typically suggests a strong upward movement following a consolidation period. The technical pattern emerged after Ethereum experienced a significant price increase and resolved when ETH surpassed the upper trendline at $2,550. Technical analysts predict Ether could surge by 56%, aiming for an ETH price target below $4,000.

The bullish scenario depends on maintaining crucial support levels without any breaches. According to crypto analysts the ETH price must remain above the $2,400 support zone to sustain its upward trend. To maintain the potential for ETH to climb first to $3,500 and then reach the $4,000 target price, which remains a key ETH price target, it is vital to sustain this price level.

The final consolidation for $ETH before a breakout.

— Michaël van de Poppe (@CryptoMichNL) May 23, 2025

I think that we'll see altcoins outperform Bitcoin as the conviction starts to come back.

Breaking through this resistance zone for $ETH would initiate a move towards $3,500. pic.twitter.com/yBeXqphHXr

On-Chain Metrics: Surging Network Activity and Fees

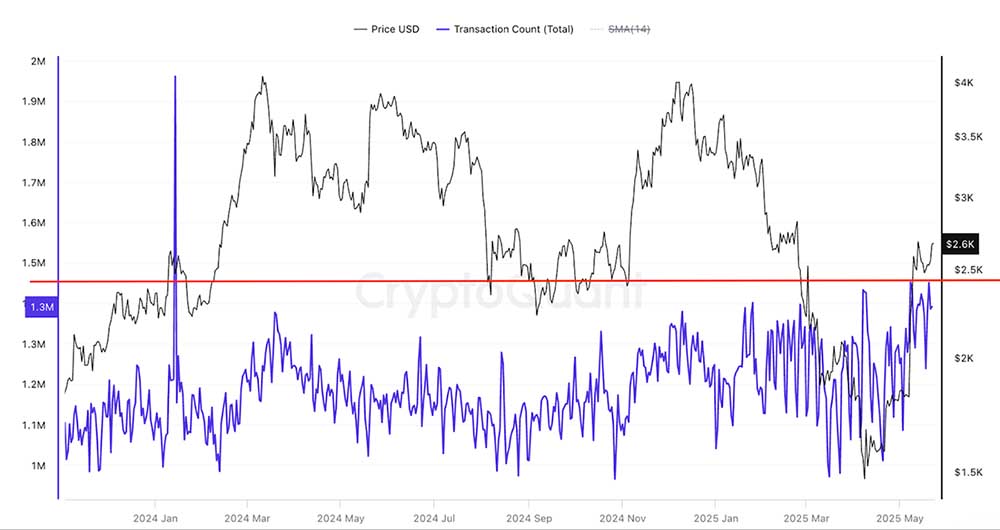

Ethereum’s price strength shows a direct relationship with the substantial increase of its on-chain actions. In the previous month the network experienced a 37% rise in daily transactions which brought activity to its highest level since January 2024. The current period of increased engagement matches the time when Bitcoin ETFs boosted crypto prices and indicates a resurgence of active participation throughout the ecosystem.

Ethereum’s daily transaction fees reached a 90-day record of 0.0005 ETH ($1.33) on May 22 as transaction counts increased. The substantial transaction counts and fees demonstrate increased user involvement with decentralized applications (DApps), NFTs, and DeFi protocols. Historical patterns show that when network utilization increases along with gas fees, Ether prices tend to rise due to demand growth.

Ethereum Ecosystem Growth and Investor Confidence

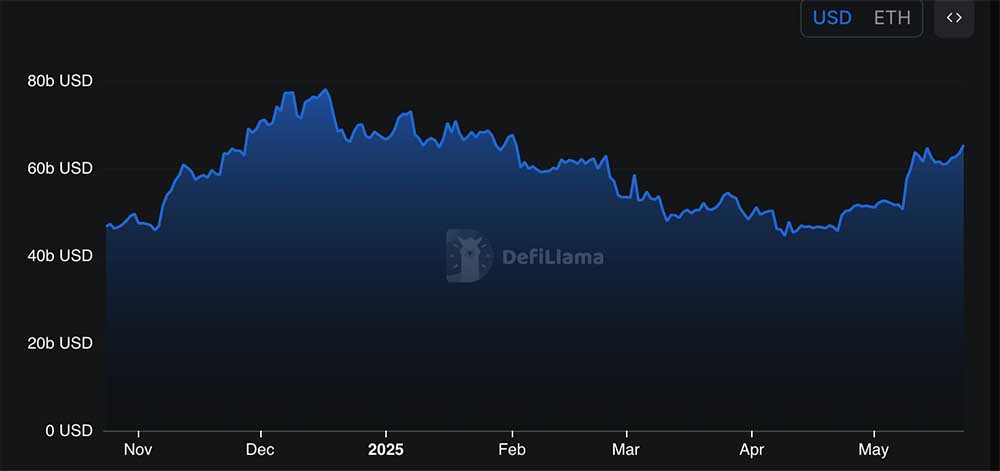

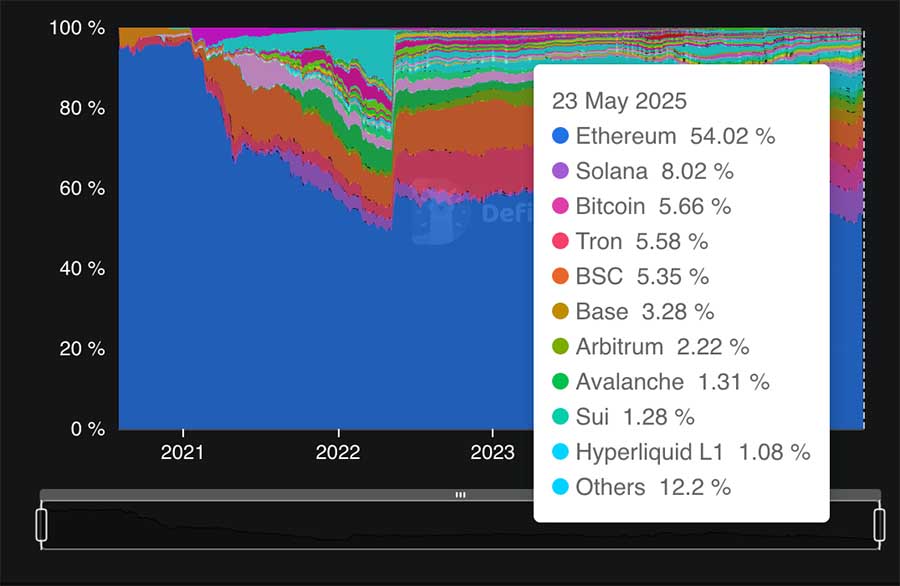

The Total Value Locked (TVL) demonstrates significant Ethereum ecosystem growth beyond transactional metrics. Network smart contracts exhibited strong total value locked growth from $45.26 billion on April 22 to $65.3 billion by May 23 indicating a 44% rise within 30 days. Ethereum continues to lead in TVL control by holding a major 54% market share across layer-1 blockchain platforms.

The demand for Ether ETFs listed in the United States has increased significantly due to considerable net inflows. From May 13 to May 22, these investment products attracted $249 million in net investment flows, which demonstrates increased engagement from both institutional and retail investors. The Ethereum DeFi landscape is expanding as deposit volumes have grown substantially within protocols such as Pendle and Ether.fi/EigenLayer.

Paving the Path to $4,000: A Comprehensive Outlook

Bullish technical patterns together with solid on-chain data and rising capital inflows from investors establish a strong Ethereum price prediction for its upcoming path. The “bull flag” pattern confirmation alongside increased network activity and transaction fees builds a strong technical basis for ongoing price growth. The combined indicators demonstrate increasing usefulness and trust in the Ethereum network.

The continuous Ethereum ecosystem growth, which draws substantial capital investment, makes the $4,000 price target appear more achievable. The consistent increase in Total Value Locked, combined with positive ETF flows, demonstrates widespread market confidence in Ethereum’s future prospects. Market participants who track Ethereum price trends should focus on crucial support levels to anticipate significant price increases, which match strong Ethereum price predictions.