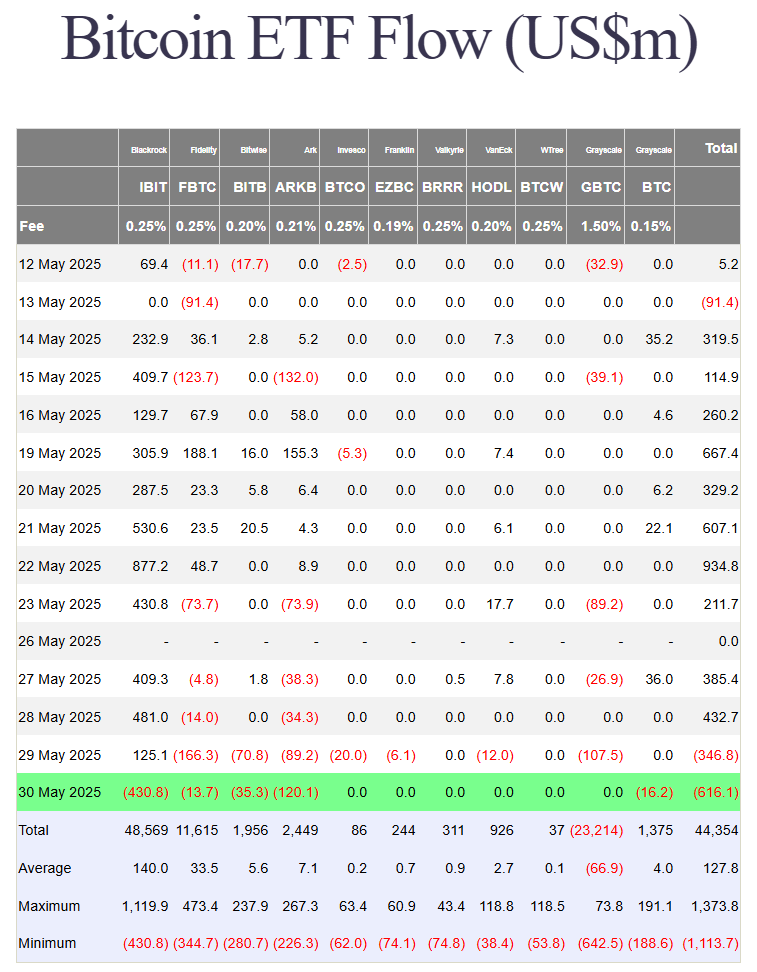

The BlackRock Bitcoin ETF (IBIT) recently encountered its greatest one-day Bitcoin ETF outflows, stopping its continuous month-long inflow period. The May 30th report revealed a substantial $430.8 million Bitcoin ETF outflow from IBIT after a consistent pattern of substantial capital attraction since its January 2024 introduction. Net outflows in the U.S. spot Bitcoin ETF market continued for two straight days as part of an expanding trend.

IBIT experienced an unprecedented withdrawal amount that was nearly $12.7 million higher than its past peak to signal significant instability in the cryptocurrency investment market. The overall U.S. spot Bitcoin ETF market experienced net outflows totaling $616.1 million during the same period. Bitcoin’s market price declined below $105,000, which demonstrates the complex relationship between institutional investment funds and the digital currency market.

Analyzing the Record BlackRock Bitcoin ETF Outflow

BlackRock’s iShares Bitcoin Trust (IBIT) saw its 31-day inflow period end on May 30 with record-breaking Bitcoin ETF outflows totaling $430.8 million. The sudden, dramatic reversal became a landmark moment for the largest asset manager because the BlackRock Bitcoin ETF had drawn consistent capital since it began. IBIT’s record single-day withdrawal reached $418.1 million on February 26, which demonstrates the immense scale of the recent withdrawal.

IBIT became a dominant force in the ETF market by attracting nearly $9.5 billion in new capital through 33 consecutive days without any outflows since April 9. IBIT’s assets under management expanded to roughly $72 billion during this time, which established it as one of the top five ETFs by year-to-date inflows in all categories. ETF analysts called IBIT’s growth since its launch earlier this year “ridiculous” and “bonkers” because of its rapid performance improvements.

Wider Spot Bitcoin ETF Market Dynamics

The large withdrawal from BlackRock’s IBIT on May 30 led to a worsening trend in the U.S. spot Bitcoin ETF market. All 11 U.S.-listed spot Bitcoin ETFs experienced a combined loss of $616.1 million in net assets during that day, which continued the pattern of back-to-back outflows. The cohort experienced $346.8 million in net outflows on May 29, which terminated their 10-day period of positive inflow performance for the combined funds.

The market experienced a significant shift following a sustained phase of substantial accumulation in the US spot Bitcoin ETF market, which gathered between $44.35 billion and $45.6 billion in net inflows since its January 2024 debut. IBIT from BlackRock managed to sustain inflows on May 29, unlike Ark Invest and Fidelity, which experienced outflows, yet the following day, the IBIT followed the market’s general trend of negative net flow.

Bitcoin Price Reaction and Expert ETF Insights

Bitcoin ETF outflows surged at the same time Bitcoin’s spot price faced renewed selling pressure. Bitcoin dropped from its weekly peak of $110,000 to below $105,000 by Thursday before settling near $103,000 on Saturday as investors pulled significant capital out of the market. Market analysts have asked questions about this price movement since prior substantial ETF inflows, such as IBIT’s $6.2 billion in May, failed to generate similar price increases.

Different industry experts provide a range of interpretations regarding these market dynamics. Kyle Chasse of Master Ventures stated that the sell-off represents a deliberate supply reallocation to the strongest market players instead of a panic-driven retail exodus. Derive founder Nick Forster pointed out how substantial ETF inflows have not matched Bitcoin’s subdued price performance, which demonstrates the intricate relationship between supply levels, demand forces, and market sentiment within digital assets.

Outlook: Navigating Future Bitcoin ETF Volatility

BlackRock’s IBIT has experienced the largest Bitcoin ETF outflows to date, which, along with the wider trend of net outflows from U.S. spot Bitcoin ETFs, briefly interrupts an ongoing era of massive institutional Bitcoin purchases. Bitcoin spot price is currently experiencing a notable decline, but the BlackRock Bitcoin ETF (IBIT) remains strong with assets under management close to $70 billion. The recent pullback represents an important occurrence, yet it cannot eliminate the swift rise of this ETF product to market prominence.

Market maturity for cryptocurrencies predicts future volatility alongside changing patterns of capital movement. Today’s market conditions highlight institutional investment vehicles as major factors shaping Bitcoin’s pricing trends and investor attitudes. Despite recent outflows being the current point of focus, spot Bitcoin ETF products will continue to broaden their role within mainstream finance and gain more adoption as essential market trend indicators.