The latest Avalanche price prediction analysis reveals a substantial decline as AVAX decreased by 13.49% this week, reaching $20.07, which marks its lowest trading value in three months. The sharp AVAX price drop has surpassed February’s low of $20.20 and brought the cryptocurrency close to its March support level of $15.28. Market participants demonstrate risk-averse behavior, which stems from macroeconomic challenges combined with specific regulatory challenges affecting the asset.

The bearish market shift is primarily triggered by the SEC’s July 15 delay announcement regarding its decision on Grayscale’s spot crypto ETF for Avalanche. Investor confidence took a severe hit from regulatory indecision, even though Avalanche’s institutional interest was growing and VanEck had just launched a special institutional fund.

Regulatory Setbacks: Spot Crypto ETF Delays Dampen Investor Confidence

The July mid-point verdict delay from the SEC on Grayscale’s AVAX ETF proposal led to a drastic reduction in market enthusiasm. The market faced disappointment because VanEck launched an institutional fund for Avalanche shortly before the delayed ETF decision, which had initially raised expectations for increased institutional investment. The asset experienced a significant pullback as market sentiment cooled under regulatory uncertainty.

The uncertainty with Avalanche’s ETF isn’t an isolated case since Cardano (ADA) has experienced equivalent regulatory delays followed by market declines, which suggests a widespread issue. The SEC’s decision to delay the AVAX ETF ruling until mid-July has deflated market enthusiasm and demonstrated how spot crypto ETF decisions affect investor sentiment. The persistent uncertainty of spot ETF regulations for key layer-1 networks creates market confidence issues, which block potential bullish trends from institutional product launches.

AVAX Technical Analysis: Indicators Confirm Downward Spiral

Under technical analysis, the Avalanche price prediction for AVAX is negative because its daily chart shows a clear breakdown from a descending triangle pattern. The $21 support base failed to hold its position as the price descended below this critical level, which had remained intact since April through multiple lower highs. The downward movement illustrates a bearish trend, which intensifies due to increasing sell pressures and Avalanche’s inability to maintain the $20.50 support level.

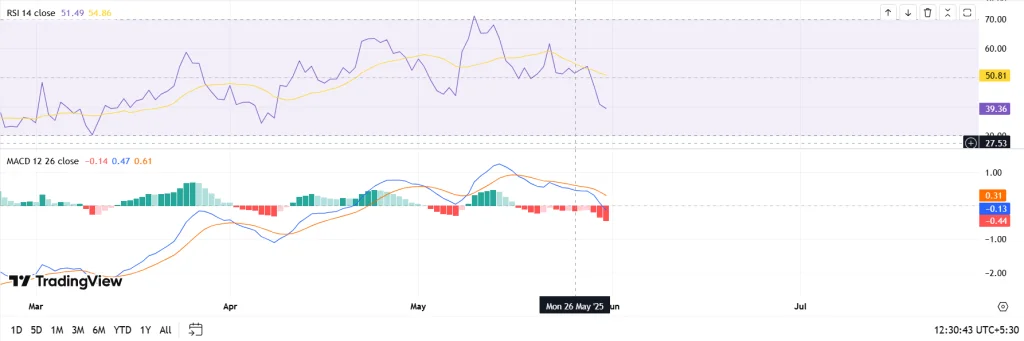

Momentum indicators further reinforce this bearish outlook. The RSI reading stands at 39.79, indicating bearishness, while the MACD histogram displays more red divergence between its lines. The Bull-Bear Power (BBP) indicator reached its lowest point at -4.44 since April, which shows sellers have fully dominated over bullish buying pressure.

On-Chain Data: AVAX Holders Face Losses and Outflows

The latest on-chain metrics show sustained weakness and substantial capital withdrawal from Avalanche, contributing to the recent AVAX price drop. Decentralized finance protocols on Avalanche experienced a significant reduction in Total Value Locked, which fell from $1.581 billion on May 28 to $1.473 billion by May 31, describing a 3-day drop of $108 million. The 6.82% decrease demonstrates reduced user activity along with the withdrawal of investment funds.

The bearish argument is strengthened by the steady withdrawal of users from exchanges. The $4.34 million net outflow during May 30-31 reveals that users are shifting their AVAX from platforms, possibly to sell or keep it off-exchange, because of risk-averse market sentiment. More than 90% of AVAX holders experience losses while only 3.93% have earned profits, which signals a potential for further capitulation when vital support levels break.

Avalanche Price Prediction: Navigating Continued Downside Pressure

Avalanche’s price falling below its February low demonstrated a clear bearish pattern, which influences the short-term Avalanche price prediction and suggests a retest of the key March support level at $15.28 may happen. Negative technical indicators and bearish momentum remain aligned, which continues to force prices downward, resulting in a tough upcoming period for the asset.

The short-term Avalanche price prediction suggests a potential drop to $15.28 if the $19.50 level cannot maintain its support. The bearish trend is expected to continue through mid-June because the market faces uncertainty about ETF approvals, and most AVAX investors are at a loss unless new buying interest emerges to transform the market dynamics.