Although NFT market activity has broadly cooled, Pudgy Penguins marches to the beat of its own drum. NFT sales volume for the week declined 33.56% to $169.7 million (from $256.9 million) in the recent crypto market crash, but several high-performing collections, including DX Terminal and the penguin-branded mainstay rose in price. Is it possible for select, IP-forward collections to uncouple from macro headwinds? One thing is certain: Pudgy Penguins NFT sales are going against the overall trend.

Pudgy Penguins NFT Sales: Unique Buyers Plunge, Dollars Hold Steady

Stepping back, the key data points paint the picture of a sharp cooldown. Unique buyers dropped 75.68% to 168,946 while sellers declined 73.94% to 152,283. Transactions surprisingly increased 1.99% to 1,920,271, a sign that smaller ticket sizes, more bots, or micro-flipping may be propping up the contraction in dollar volume. In short, the market is active but just at lower price points.

Pudgy Penguins NFT Sales: Collections In Focus

DX Terminal took the lead of the collections leaderboard, scoring $13.03M in weekly sales (an increase of 50.20%), across 570,066 transactions with an ample pool of buyers and sellers. CryptoPunks lagged behind at $11.06M (down 36.92%), while DMarket closed at $7.72M (down 3.33%), which is not immune from rotation pressure despite blue-chip status.

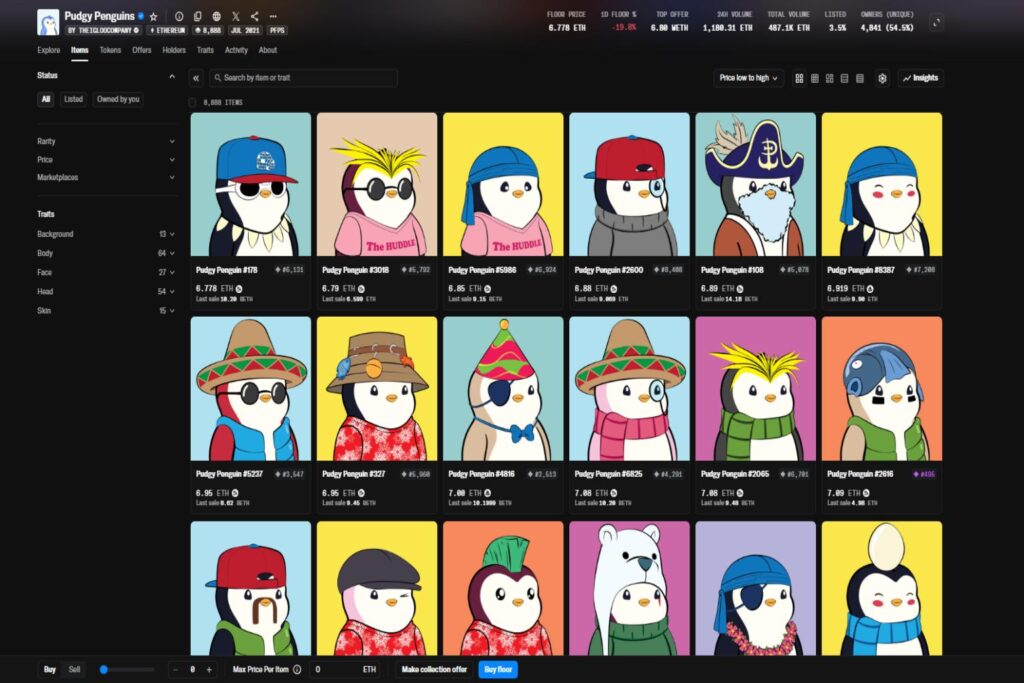

The wild card of the week was Pharaoh V3 Non Fungible on Avalanche, skyrocketing to $7.34M, an anomalous increase of 41,365.84% on a small sample of 554 transactions. Moonbirds had a quiet week at $7.01M (down 60.89%), while Pudgy Penguins rose to $6.63M, a gain of 16.98% week over week, recorded across 172 transactions. Bored Ape Yacht Club rounded out the top 7 at $5.30M, a positive increase of 90.38%, which may be a sign that there are a few risk-on flows amid choppy conditions.

Takeaways for Brand Builders: Identity Drives Behavior

Narrowing the lens to specific collections with an enduring competitive advantage: Collections with an accessible, appealing identity (Penguins, Pepe), strong community discipline (daily social posts, scavenger hunts, public events), and omnichannel marketing (physical tie-ins, retail appearances, social storytelling) are fighting for mindshare and attention. It’s the context for why Pudgy Penguins NFT sales are bucking the trend, which should be taken as a case study for how to make an IP-led play.

Pudgy Penguins NFT Sales: Blockchains Categorization

By chains, Ethereum remains the magnet with $86.46M in weekly NFT sales (down 9.34%) — but with reported wash trading at $12.46M, a cumulative total quoted at around $98.92M. Unique buyers on Ethereum declined 81.35% to 19,509. Base remained at the second place with $15.56M (up 39.75%) in sales, including $5.29M in wash trading; buyers on Base decreased 66.63% to 95,027 which is still an outsized user base compared to most of the other networks. Bitcoin rose to third place at $14.04M (up 20.92%) with just 3,188 buyers (down 86.51%), a testament to a more concentrated high-value space.

Mythos Chain registered $12.86M (down 2.13%) as the number of buyers decreased 79.07% to 9,568. Avalanche made a surprise leap to $10.63M (up 373.13%) even though the number of buyers plummeted to 280 (down 88.49%), a reflection of both large average deal sizes and potentially a handful of breakout collections (Pharaoh V3 as a case in point). Solana notched $7.58M with a negligible week-over-week change, and 9,554 buyers (down 83.18%), a number that suggests softness in participation is cross-chain.

Insight for Data-Driven Traders: Liquidity Dispersion

The dispersion of data points is an opportunity set for data-driven traders: Liquidity has not left the market — it has clustered around fewer narrative-rich collections. A dynamic that has implications for Pudgy Penguins NFT sales performance relative to the broader NFT field.

Macro: Crypto Market Takes A Breather, Narratives Take Center Stage

Zooming out to the entire crypto market, there was an evident cooling: Bitcoin retraced to around $112,000 (−1.23% on the day, in the latest data check) while Ethereum drifted to around $3,700 (−0.57%). The total crypto market cap eased to $3.78 trillion from $4.2 trillion a week earlier. In volatile risk markets, even temporary shifts in sentiment can heavily impact the illiquid NFTs subsector. For that reason, the fact that Pudgy Penguins NFT sales continue to increase despite a broad-based volume contraction is a sign of brand-specific demand and not general market beta.

Why are Pudgy Penguins NFT sales holding strong?

Several dynamics come into play:

- IP-led approach: Penguins are ubiquitous and meme-able, which provides a lot of reach organically.

- Omnichannel rollout: Tying into tangible products, retail lines of sight, and more ‘accessible’ popular entry points create a marketing funnel beyond just crypto-curious users.

- Cadence: Staying consistent on social, doing collaborations, and building IRL moments help maintain momentum even when the market doesn’t cooperate.

Of course, none of the above bullet points serve as a long-term shield to protect a collection, that’s not how it works. However, what they can do is build long tail endurance. The rise in Pudgy Penguins NFT sales in a week of sharp contractions in buyers and sellers suggests a fan economy that is more resilient, that is less correlated to price action, and that is more cultural.

A few things to watch going forward

- Premium sustainability: Will floor prices and secondary velocity be able to sustain themselves in the case of a crypto market that drifts flat?

- Cross-chain exploration: Will more established brands test their mettle on the aforementioned Base and Avalanche for new mints, drops, or gamified launches?

- Wash-trade activity: Need for continued diligence in dissecting chain-level totals, in particular on more rapidly growing L2s.

- Macro catalysts: Macro catalysts such as policy headlines, ETFs listings, and L2 incentives can also quickly turn the tide — and liquidity — on collections.

Creators and collectors take note: in volatile markets, a powerful brand narrative and laser focus on execution can outperform just having raw market exposure. Collections that ship, show up, and speak the same language as their community will win the attention economy, and right now that’s exactly what Pudgy Penguins NFT sales are suggesting.