What Is Flag Pattern in Trading and How to Trade It? Best 2026 Guide

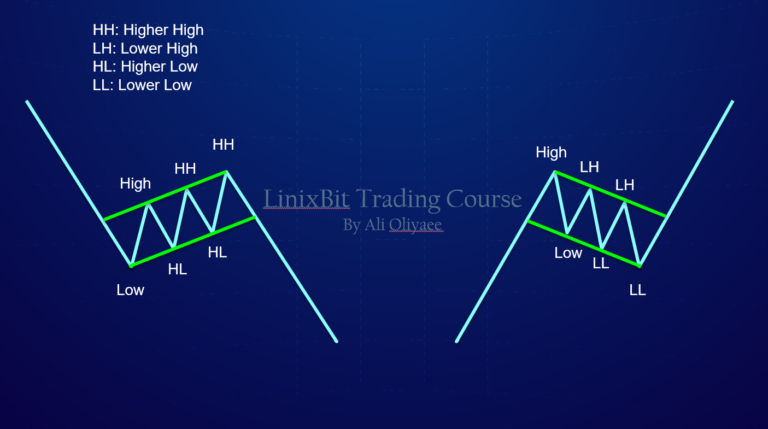

In technical analysis, traders use chart patterns to identify potential price movements based on historical data. One of the most popular patterns that traders look for in their analysis is the flag pattern. But what is flag pattern in trading? A flag pattern is a continuation chart formation that occurs during a strong price trend, either upward or downward. It signals a brief pause or consolidation in the market before the price resumes its original trend. The pattern is called a flag because the price action forms a rectangular shape